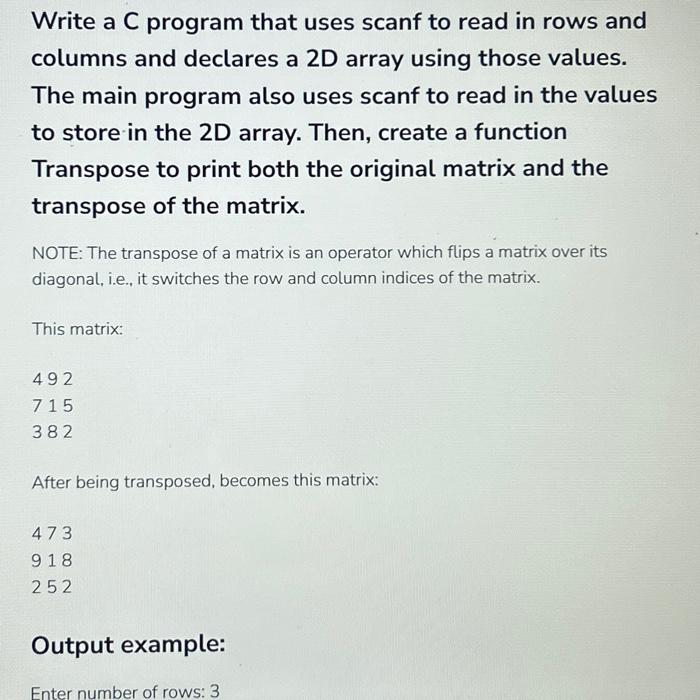

Description

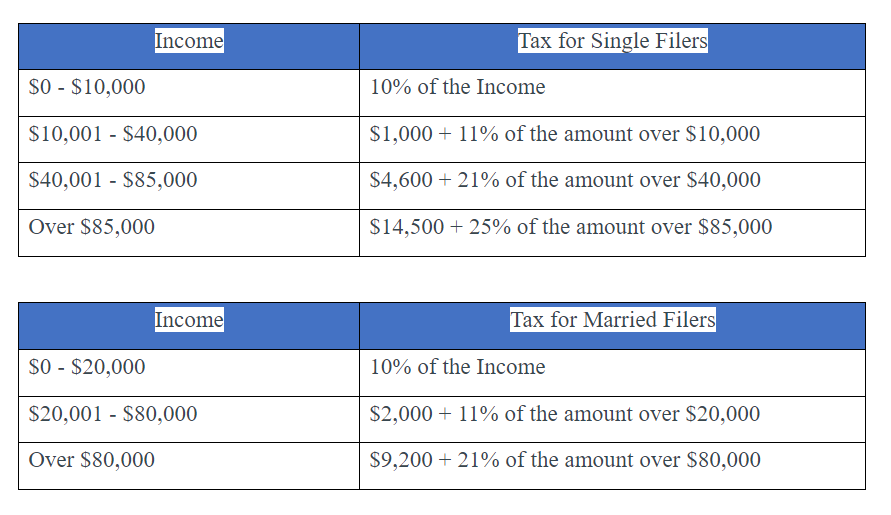

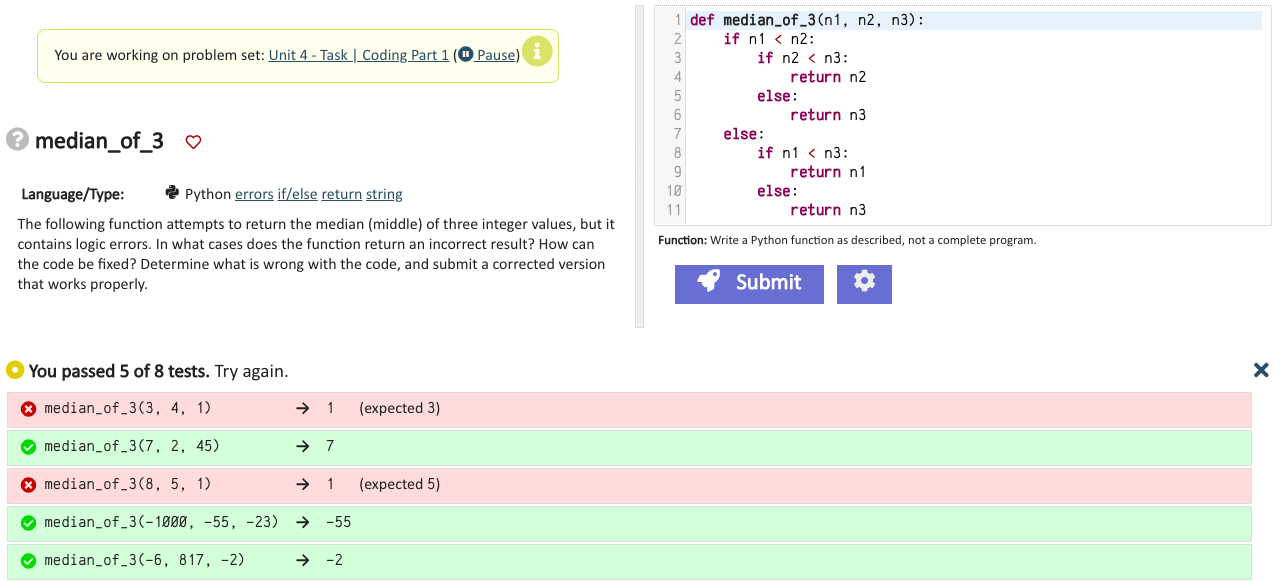

Write a program in Thonny that will calculate income tax owed given wages, taxable interest, unemployment compensation, status (single or married) and taxes withheld. Taxpayers are only allowed to use this short form if adjusted gross income (AGI) is less than $120,000. Dollar amounts are displayed as integers with comma separators. For example, print(f”Deduction: ${deduction:,}”).Hint – it will be one program but build this program in steps.Step 1 – Get Input – You will input wages, taxable interest, unemployement compensation, status (1=single and 2=married) and taxes withheld as integers.Step 2 – Calculate AGI – You are to calculate the adjusted gross income (AGI). It is calculated as wages + interest + unemployement. Output error message if the AGI is above $120,000 and the program stops with no additional output.Step 3 – Identify Deduction Amt – deduction amount based on status: (1) Single=$12,000 or (2) Married=$24,000. Set status to 1 if not input as 1 or 2. Calculate taxable income (AGI – deduction). Set taxable income to zero if negative.Step 4 – Calculate Tax Amount – Calculate tax amount based on exemption and taxable income (see tables below). Tax amount should be stored as a double and rounded to the nearest whole number using round().Step 5 – Calculate Tax Due or Refund – Calculate amount of tax due (tax – withheld). If the amount due is negative the tax payer receives a refund. Output tax due or tax refund as positive values You will be running the program with inputs based on your student number. You will divide your student number by 100 to get the amount for wages for run 1. For run 2, you would add $10,000Eg – my student number is 5921362, then my wages are $59,213 for run 1, and $69,213 for run 2.Run your program twice using the numbers in the table above, but replace the Wages with the wage based on your student number (student number / 100, student number / 100 + 10000).

![Write a Python function that takes as input three integers, M, N, and r, and returns an MN matrix of rank r. Create matrices of different sizes and ranks, and use numpy.linalg.matrix_rank() to verify the returned matrices have the desired rank. Why should you expect a randomly generated matrix to have the rank you prescribe? What happens if you set r > min(M, N), and why does that happen? def randrank(M, N, r): A = random.randn(M, r) B = random.randn(N, r) return A.dot(B.T) R = randrank(32, 41, 7) print(R.shape, 'n') print(LA.matrix_rank(R), 'n') (32, 41) 7 (a) Use the function in Exercise #1 to generate a 5020 random matrix of rank r = 20, and visualize it. (b) Find the SVD of the matrix in part (a) using numpy.linalg.svd(). (c) Reconstruct the MN 2D array s with the entries of along its diagonal and zeros everywhere else: S = [s100000, s200000, sN00] if M > N, or S = [s1000, s2000, sM000000] if M < N (d) Verify that U.dot(S.dot(Vt)) recovers the matrix created in part (a). (e) Repeat (a) - (d) for a randomly generated 2050 matrix of rank r = 20.](https://gotit-pro.com/wp-content/uploads/2023/10/9d894064-eba6-456a-bd74-1f134ab849c5.png)

Yizhe Gao –

Follows the required notes. Right on time. Amazing solution.

Patrick Lorenz –

I am glad I got assistance, I’m am very happy with the service.