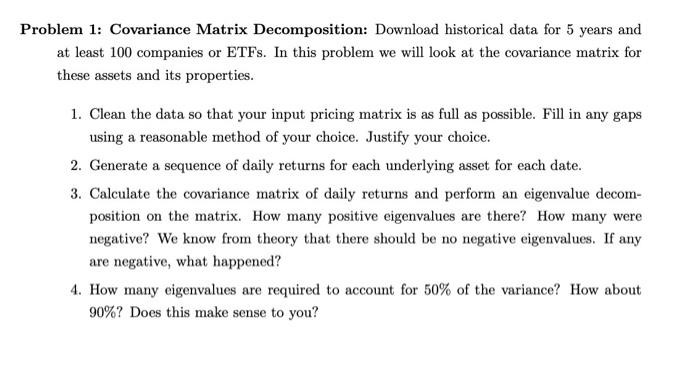

Problem 1: Covariance Matrix Decomposition:

Download historical data for 5 years and at least 100 companies or ETFs. In this problem, we will look at the covariance matrix for these assets and its properties.

1. Clean the data so that your input pricing matrix is as full as possible. Fill in any gaps using a reasonable method of your choice. Justify your choice.

2. Generate a sequence of daily returns for each underlying asset for each date.

3. Calculate the covariance matrix of daily returns and perform an eigenvalue decomposition on the matrix. How many positive eigenvalues are there? How many were negative? We know from theory that there should be no negative eigenvalues. If any are negative, what happened?

4. How many eigenvalues are required to account for 50% of the variance? How about 90%? Does this make sense to you?

25% off with code “SUMMER”

25% off with code “SUMMER”

Ty Miyahara –

Thanks a lots, I really appreciate your effort it is an excellent report.

Jeff Minyard –

Excellent, thank you! Got solution extremely fast, within minutes.

Jp Grillo –

great work as usual thanks

Gordon Benton –

Second time coming to this website for a paper and it worked out great.