Data is the New Oil We are the New Rig

Extract the right data from the right source with highest accuracy with our professional service.

Our latest items

-

Computer Science, Visual Basic

Rated 5.00 out of 5$60.00Original price was: $60.00.$50.00Current price is: $50.00. Add to cart -

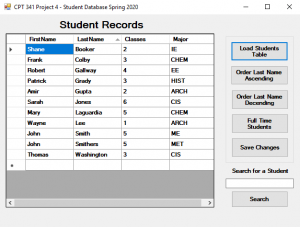

Computer Science, CPT 341 Spring 2020, Visual Basic

Rated 5.00 out of 5$60.00Original price was: $60.00.$50.00Current price is: $50.00. Add to cart -

Computer Science, CPT 341 Spring 2020, Visual Basic

Rated 5.00 out of 5$100.00Original price was: $100.00.$75.00Current price is: $75.00. Add to cart

Why Gotit Pro?

We believe in customized data and solution for your project and business, because every idea is unique. With a one-stop-shop service and superb support you’re in good hands.

Smart ideas

With dozens of intelligent concepts, you’ll find what you’re looking for in our store, and it will be unique and personalized to match.

Outstanding support

Our customer support is second to none – users rave about how we don’t rest until every issue is solved to their satisfaction.

Secure checkout

With 128-bit SSL security with advanced encryption you are guaranteed that your purchases are safe.

Real talk from our real customers

Loyal customers, they don’t just come back, they don’t simply recommend you, they insist that their friends do business with you.

I just can’t recommend Shoptimizer enough. I feel like I’m on a first-name basis with some of the crew, they’re just so unbelievably helpful, no matter what the question. Their products are also so beautifully well made and easy to maintain, they’ll last for years to come.

Every order from Shoptimizer has been an amazing experience. their site provides lots of detail so I know exactly what I’m getting and their customer support is just outstanding. I needed to swap an item for a different size and they arranged everything for me within 24 hours.

Offer of the week!

Outdoor essentials from legendary designer Tom Woo available at 25% off for one week only. Don't miss out on this incredible deal!

Our most popular products

-

Introduction to Sociology, OpenStax - Introduction to Sociology 2nd Edition

Rated 5.00 out of 5$15.00Original price was: $15.00.$12.00Current price is: $12.00. Add to cart -

Computer Science, CPT 341 Spring 2020, Visual Basic

Rated 5.00 out of 5$100.00Original price was: $100.00.$75.00Current price is: $75.00. Add to cart -

Computer Science, CPT 341 Spring 2020, Visual Basic

Rated 5.00 out of 5$60.00Original price was: $60.00.$50.00Current price is: $50.00. Add to cart

Brands we stock

We pick the very best so you can be assured of the quality. There can be no compromises when it comes to materials, ease of wear, and durability.